International Trade Finance Solutions via Trade Factoring Entity – TFE

By: HJ Global Solutions (OPC) Private Limited

SERVICES OFFERED

ACCOUNTS RECEIVABLE FINANCING

Accelerated Cash Flow

TFE advances up to 95% of invoice value and funds within 24-48 hours of receiving your request.

Credit Protection (Non-recourse)

TFE eliminates buyer credit risk by insuring your accounts receivable and covering the risk of shortfall of payment due to buyer’s insolvency.

Collections and Reporting

We perform collections, buyer credit reviews and accounts receivable bookkeeping on your behalf.

Offer Longer Payment terms

You can generate more sales by offering longer payment terms without disrupting cash flow.

SUPPLY CHAIN FINANCE

- TFE’s supply chain finance programs helps align the needs of both buyers and suppliers and minimize risk across the supply chain.

- TFE ensures that suppliers have cash on time so buyers can expect quality products delivered without delays and in full.

- TFE providesfactoring,purchaseorder funding, inventory lending, letters of credit, and structured guarantees.

- TFE can supportfacilities based on payables, receivables, and inventory.

- TFE provides funding to foreign suppliers based on the creditworthiness of their buyers.

TFE Finances:

- Manufacturers & Processors

- Importers & Exporters

- Branded Companies

- Wholesalers & Distributors

- Traders

Industries Served:

- Textile

- Beverage

- Media

- Industrial & Mechanical

- Electronics & Consumer Goods

Payment Terms:

- Open Account

- DA

- DP

- CAD

- LC

Export Factoring:

Post Shipment

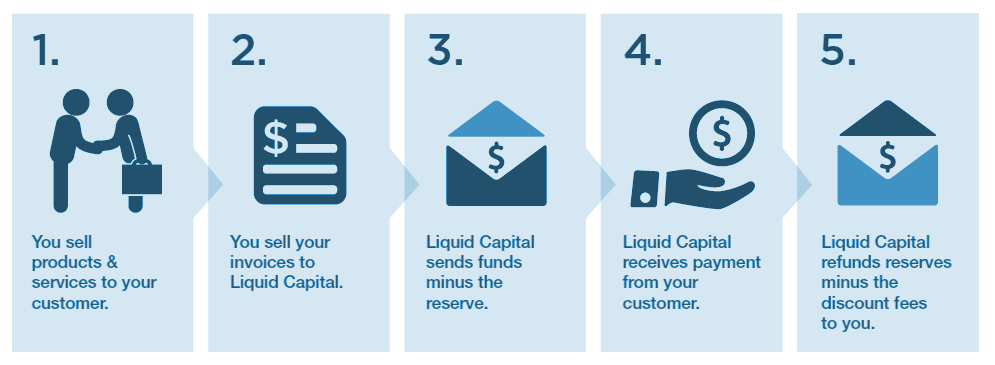

How it works:

- Supplier invoices buyer

- TFE advances up to 95% of invoice within 1-2 days

- On invoice maturity, buyer pays TFE and then, TFE remits the reserve to the supplier.

Supply Chain Finance

Pre-Shipment & Post Shipment

How it works:

- Buyer issues PO to supplier

- TFE pays for raw materials

- Supplier invoices buyer

- On invoice maturity, buyer pays TFE

Types of Client:

Fast Growth:

- For most fast-growth companies, bank financing will not only be limited but also limiting

- Factoring and trade finance provides ongoing support with no ceiling or cap.

Buying & Selling Internationally:

- Most other factoring and finance companies, and even many banks, will not offer financing on international sales.

- TFE can replace or supplement your existing financing arrangements.

Financially Stresses or Impaired:

- In today’s economy, banks’ and traditional lenders’ credit and underwriting standards have become increasingly stringent and unrealistic.

- TFE can be your flexible alternative.

Asset – Light and/or Capital Intensive:

- Trading companies often lack tangible assets but have large purchase orders and receivables.

- TFE leverages these receivables for working capital needed to optimize marketplace opportunities.

New Client On Boarding:

Step 1

Limit

TFE provides credit check services for the exporter and establishes credit limits on their international buyers.

Step 2

Due

TFE researches the background of the exporter’s overseas buyers and gathers information and documents from the exporter.

Step 3

Factoring Agreement

The exporter receives the final quoted price and signs the factoring agreement.

Step 4

Change of Beneficiary

Overseas buyers sign the intro letters and are instructed to make payments to our account

Step 5

Funding

TFE starts funding the exporter after receiving the confirmation of invoice, packing list, bill of lading and PO.

Benefits of Trade Factoring:

Turn Accounts Receivables into cash within 48 hours:

We offer a quick turnaround from initial contact to account setup and funding is provided within 24-48 hours of invoice submission to free up cash flow.

100% Credit Protection:

You have peace of mind as we monitor the credit worthiness of your customers and assume the risk of shortfall of payment due to their insolvency.

Tailored Solutions:

We offer scalable funding that grows with your company and adapts to the different conditions of each country, specific products, customers and payments terms.

Greater Access to Financing:

We finance you even if you don’t qualify for traditional bank services as we primarily focus on leveraging the credit of your clients or your entire supply chain.

Collections and Reporting:

Our local experts act as an extension of your back office and perform collections, dunning and accounts receivable bookkeeping on your behalf.

Off-balance Sheet:

Our services are not loans so, for many companies, our financing doesn’t show up on their balance sheet as debt.

Financing Options:

Trade Finance vs Bank Finance

Structure:

- Debt vs. non-debt

- Security & collateral vs. non-recourse financing

Flexibility:

- Seasonality and growth accommodation

- Alternative financing with an easier and faster application than bank

loans

Relationship:

- We understand the nature of your business

- Leverage Trade Factoring Entity global supply chain network and international offices