HJ Global Solutions

Dr. Himani Jolly, Founder President and CEO

Dr. Himani Jolly, Founder President and CEO of HJ Global Solutions has more than 16 years of experience with the big corporate working across the globe. She has vast knowledge on Indian and Foreign countries business corporate working area and their working styles. She has visited many countries across the Globe and has been consulting the business corporate for their variety of business needs such as suitable Land and Machinery, Best Climate Conditions to Setup, Business Planning & Strategies, Business Startup Plans, and much more to say…

Dr. Himani Jolly, Founder President and CEO of HJ Global Solutions has more than 16 years of experience with the big corporate working across the globe. She has vast knowledge on Indian and Foreign countries business corporate working area and their working styles. She has visited many countries across the Globe and has been consulting the business corporate for their variety of business needs such as suitable Land and Machinery, Best Climate Conditions to Setup, Business Planning & Strategies, Business Startup Plans, and much more to say…

To Assist Business Corporate And Startups In Transforming Their Business Ideas Into A Reality.

To Assist Business Corporate And Startups In Transforming Their Business Ideas Into A Reality.

About HJ Global Solutions

HJ Global Solutions is a Team of Business Consultant Experts, first came into an existence in the year 2016 in India. Since the year 2008, we have been working as an NGO “Maitreya Organization”. We, HJ Global Solutions, help future Industry Leaders Breakthrough their biggest challenges to creating superior outcomes. We customize the powerful strategy for our business clients and provide them an excellent plan on an execution of their business idea to get their full potential to enjoy fast results along with long-term success.

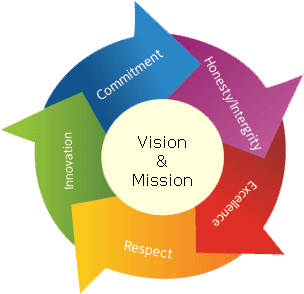

Vision & Mission

We help our clients to get complete Business Transformation Solutions. Our team of experts consults the business to achieve a higher-level vision and meet their biggest challenges. Our Team of Experts (TOE) knows “what is the suitable way to achieve your targets and how it will be achieved in your own way to produce same breakthrough results for your business.”

Inquire Now

ABOUT H J Global Solutions Pvt. Ltd.

H J Global Solutions Pvt. Ltd. is a growing company in India which delivers modern infrastructure, commodities, asset management and structured funding. The Company has been operating globally, mainly from London, UK since 2009 and from India since 2016. It has registered in India due to reasons of developing short route through this country. Our firm has been built upon a foundation of corporate finance expertise, practical experience, and legendary customer service.

We offer the funding for the social, economic and humanitarian projects. These development projects include underprivileged children programs, government infrastructure, hospitals, oil refineries, power stations, technological advancement, alternative energy projects, residential or social housing, or incorporating renewable energy solutions, educational activities and many social development programs governed by all state and national governments to deliver a sustained low cost of living.

In addition, we are funding all industries like metal, infrastructure, refineries, water, roads, houses and all government schemes. Other service areas of the company are all establishments like land, construction, skilled labor and training programs related to all tools and machinery.

Accessing Our Services

HJGS team focus on finding you the right solution for your funding needs. When you call, our staff will guide you through our services. Comprising a small but highly trained team, with expertise and knowledge in the range of funding products on offer, you can be assured of a friendly, approachable and, of course, confidential service delivered by an experienced team of finance professionals.

Our promise to you:

Our promise to you:

- A fast and professional evaluation of your financing needs.

- A timely commitment of any funding to be provided.

- A clear presentation of our proposed financing plan for your project.

If one of our programs is right for you, we will go through your project, complete a preliminary analysis and issue a proposal letter outlining our recommendations and costs. We have a complete infrastructure to make an audit on every project whether this is government project or corporate. Every proposal has different area of working so first we will need to develop understanding of all requirements of project then our team will guide them to make a Performa.

If you accept, we begin a formal “due diligence” process and present you with a tentative closing schedule.

Any state or central government can take loans from the company at low rate of interest as compared to other banks and financial institutions. We can raise the fund for several plans and programs of government about the schemes, any project for humanitarian or development of status. Our product offerings are structured to provide you with maximum flexibility in creating the right financing package for you.

Key Features

- Charges: We provide this fund as loan only with very low rate of interest. There is different policy of some extra charging system on rate of interest for corporate area. At the same time, there is guarantee liberty for the borrower as the borrower needs to submit 10% seed money as a security deposit in selected European banks. 1% consultancy fee of total cost of project is changed by us as consultancy.

- This fund is coming from top 25 AAA+ banks throughout the world as we are dealing with all these top banks of the world.

- Loan Amount: We provide loan in minimum amount of $4.47Billion up to $44.7 Billion. We deal only in pound/Euro/Dollars not in INR.

- Term: Tenures will be 10 to 20 years.

- Loan to Value: Up to 100% of project financing required.

Operation: Projects can be either BOOT (Build, Own, Operate, Transfer), BOO (Build, Own, Operate), BOT (Build, Own Transfer), BT (Build, Transfer), BLT (Build, Lease, Transfer) or PPP (Public Private Partnership).

Like Us

We target lending to:

We target lending to:

- Privately held projects

- Public & Private Infrastructure Operators

- National & Local Governments

- NGOs and Financial Institutions

Competitive Edge:

In addition to our in-depth sectoral knowledge, efficient transaction processing and management capabilities, certain factors make use different from the competition are:

- Speed of execution: It depends on how much time state or central government process. In every corporate house, this works very fast because they have particular system to work on it but with any government it takes so much time because of

baeurocrates. In normal circumstances, it takes 3 months.

baeurocrates. In normal circumstances, it takes 3 months. - Privacy: HJ Global Solutions keeps privacy and confidentiality of the clients as it does not publicly disclose its holdings or financial affiliations.

- Loan Amount: Our affiliated partners offer up to 100% debt funding which is based on project. Certain Banking and Financial Institution are not able to provide a straight forward 100% project loan.

- All approvals undergo an intensive audit process.

- Integrity: No hidden costs

Private Structured Funding

The clients can access private structured funding from HJ Global Solutions and our partners for their Project requirements. This funding type is sourced confidentially through our relationships with banks. It is allowed to applicants to make any changes in funding requirements prior to contracts.

For serving clients, there is a team of highly experienced advisers, outsource specialist expertise where necessary to maintain funding resources for capital projects in many industry sectors. We can also consult on all funding aspects with our international capital markets associations.

Our Partners Funding Proposition:

The component markets each have a long track record:

- The Banking Guarantee/Sovereign Guarantee Market

- BG/SG have been issued as collateral for decades

- Trade Finance is a thriving International Market

- Project Bonds

- Conventional finance through major international banks

- Securitization, Monetization

- Private equity investor groups

Our partners’ proposition brings these components together to facilitate a Project Finance Solution. Funding is generated via our banking monetizes, who create a monetized fund by monetizing the Banking Guarantee/ Sovereign Guarantee (BG/SG).

The borrowers receive loan and drawdown to their Lending SPV (Special Purpose Vehicle) which originate from loan facilities provided by Financial Intuitions (Banks, Private/ Sovereign Funds, Hedge/Pension Funds) made via credit line facilities with a collateral guarantee of a BG/SG (Banking Guarantee/ Sovereign Guarantee) and Treasury Bonds.

Finally, the borrower receives 100% funding.

Repayment of the funding will be discussed privately at a TTM meeting between our partners and the designated Government or Private institutions.

Routes of Funding

There are three types of route of funding namely sovereign guarantee, banking guarantee and cash collateral. The explanation of these funding routes as below:

1). Sovereign Guarantee:

One of the most attractive features of project financing is that it allows the sponsors of a project to guarantee the obligations of a special purpose project company in lieu of incurring direct obligations. HJGS assures about the quality of services and integrity of the business under Sovereign Guarantee.

Sovereign Guarantee is approved by the relevant authorities and departments namely the Central Bank and Ministry of Finance in the respective countries. Sovereign guarantees are given by these authorities and departments to assure project lenders that the government will take certain actions or refrain from taking certain actions affecting the project. In some cases the Sovereign Guarantee may need to be confirmed by a Commercial Bank Guarantees, Bonds or other Bank Debt Instruments issued by banks rated ‘BB+’ or better, but this can be reviewed on a case-by-case basis.

HJGS is a hybrid funding provider that charges a percentage of the total project value and fulfills overall funding requirement of the client.

This can be understood by example below:

For Instance, if there is value of a project is 1 billion (USD, Euros or Sterling Pound), then we would need to consider a Sovereign Guarantee with a minimum value of 40% of the whole project value. There will be need for us to monetize these instruments. Generally, a Sovereign Guarantee would take approximately 6 months to monetize.

2). Use of Sovereign Guarantee:

Financial guarantees are issued by States in order to financially promote projects that are related to public welfare or interest. The guarantees are used as economic incentives for the capital market to finance the projects. In Sweden, for example, financial guarantees have in the past been used to promote agriculture, fishing, housing construction, shipbuilding and energy supply. From the beginning of the 90’s, they have primarily been used to alleviate the Swedish bank crisis and for promoting investment/funding in infrastructure.

Advantages:

In comparison with on-lending, financial guarantees have the following advantages:

A). High flexibility:

Guarantees are very flexible. The fund can be provided to meet the current financing needs of beneficiaries in terms of the amount, the maturity, the interest structure and the terms of repayment. On the other hand, the funds are on-lent by the State; the borrowing must normally be adapted to total public sector borrowing in terms of foreign exchange, maturities and interest rate risks, etc.

B). Quick access to credit markets:

Guarantees bring the Beneficiary into direct contact with the credit markets, which offers an important spin-off, particularly with large-scale projects. Through direct contact, the beneficiary can have quick access to developments in financing arrangements and risk management. Moreover, it is also easier for the borrower to appoint a proficient finance manager to access finance in the market than solely contact to the State for financial requirements.

C). Diversification:

Guarantee provides diversification when the State borrowing requirement is already large. In that case, small and cheap loans with a specific structure may not be suitable for State borrowing. Such loans may therefore suitably be channeled to the Beneficiaries. However, the State may decide the minimum amount of loan on the basis of the borrowing requirement and administrative constraints.

D) No increase in state borrowing:

Loans raised under sovereign guarantees do not increase State borrowing. This factor is important when the requirement of large funding at any given time.

Banking Guarantee:

Banking Guarantees have the same minimum value of 40% like Sovereign guarantee, but it would take approximately 3 months to monetize. After this, funding can be generated. (Please be advised that the BG cannot be a leased instrument).

Cash Collateral:

We at HJGS and our partners require 20% of the project value to provide funding with a minimum of cash collateral for projects. The cash collateral has a lower requirement value as compared to a BG/SG, as there is no need to monetize and funding can be done within 30 days of the funds being transferred into a JV non-depletion account.

Key Research Findings & Opinion

- Difficulties in India providing a Banking Guarantee and a Sovereign Guarantee due to requirement of Central government authority and clearances under SG Possibility of issues with Indian bureaucrats

- On the basis of the research findings, it can be determined that the cash collateral option is the easiest and most efficient way to provide a funding route for individual states, which would not need the central governments assistance or permission to raise the funding for their own state project (s).

What we offer

We have a big Team of Experts, which is highly skilled and have a specialization in their individual field of Finance, Marketing, Human Resources, Operations, Research, and Development etc. Our aim is to cater Complete Business Transformation Solutions to our clients.

HJ Global Solutions : “Complete Business Transformation Solutions”

In detail we provide this……

Administrative Services:

- Assistance in drafting of a Business Plan Layout for new startups and new ideas for the existing setups.

- Assistance in the availability of tools and machinery along with negotiation with the suppliers for the drafting PO and agreements.

- Assistance in Implementation of the plan, Co-ordination with the manpower and establishment of an effective control system.

- Assistance in the complete requirement of Manpower and make them available the Trained Technical and Administrative Team.

R&D, Innovation and Experiment:

- Suggesting suitable and newest technology for the project.

- Identifying the required plant and machinery.

- Designing of a project plan and plant layout.

- Conducting the feasibility study of the plant.

Alternative Financing:

- Assistance in an estimation of the project cost.

- Assistance in providing financial planning for startups.

- Assistance in providing Term Loan as well as Working Capital Loans to any organization whether Government or Private MNC’s.

Project, Operations & Management:

- Assistance in searching of the suitable land for the proposed industry or project

- Suggesting suitable project or industry based on the profile of the promoter.

- Survey of the land and designing of a project layout.

- Assistance in the valuation of properties of the project and promoters.

- Assistance in obtaining legal approvals and license from the various departments for the properties.

- Assistance in Clearance from Pollution Control Board.

- Assistance in Documentation and continuation of the project.